The Great Depression: Better or Worse Than Today...?

The Great Depression: Better or Worse Than Today...?

The Great Depression: Better or Worse Than Today...?

The Great Depression: Better or Worse Than Today...?

The Great Depression: Better or Worse Than Today...?

The Great Depression: Better or Worse Than Today...?

Sep 8, 2023

Sep 8, 2023

Sep 8, 2023

How Did This Come Up? (Fair question)

I went down a deep rabbit hole this week. I saw something on Instagram comparing the great depression to today, and some of the data made me think about where our economy is REALLY at. While we won't get into the weeds in this post (happy to do it if you all ask me to!), history has a curious way of echoing through time with patterns and lessons from the past occasionally resurfacing in the present. So I thought it would be worst visiting the topic. In economic history, the Great Depression of the 1930s stands as one of the most harrowing chapters, marked by widespread unemployment, financial turmoil, and social upheaval. As we navigate the difficult conditions of today, it's worth thinking about the parallels and differences between these two times.

Background: The Great Depression

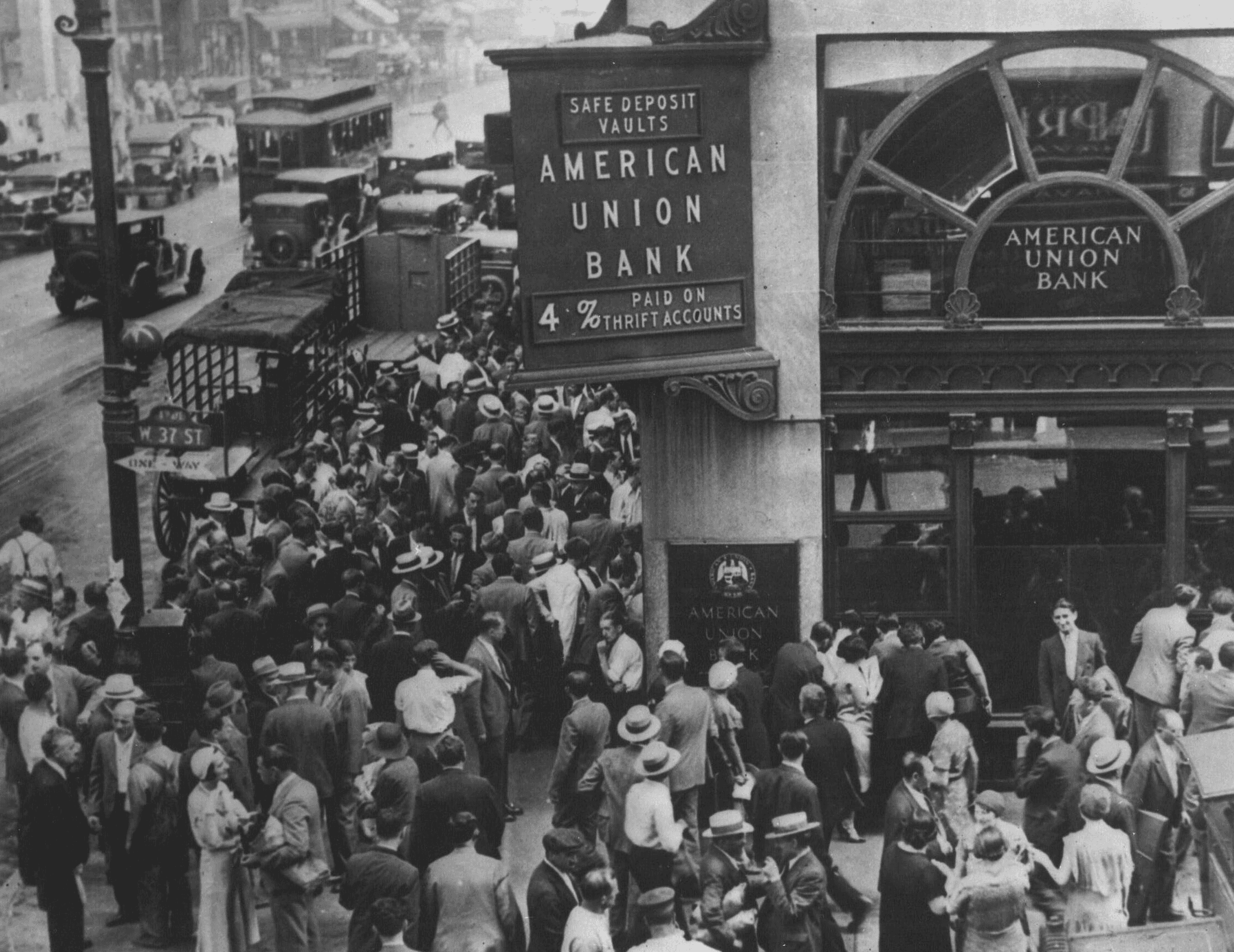

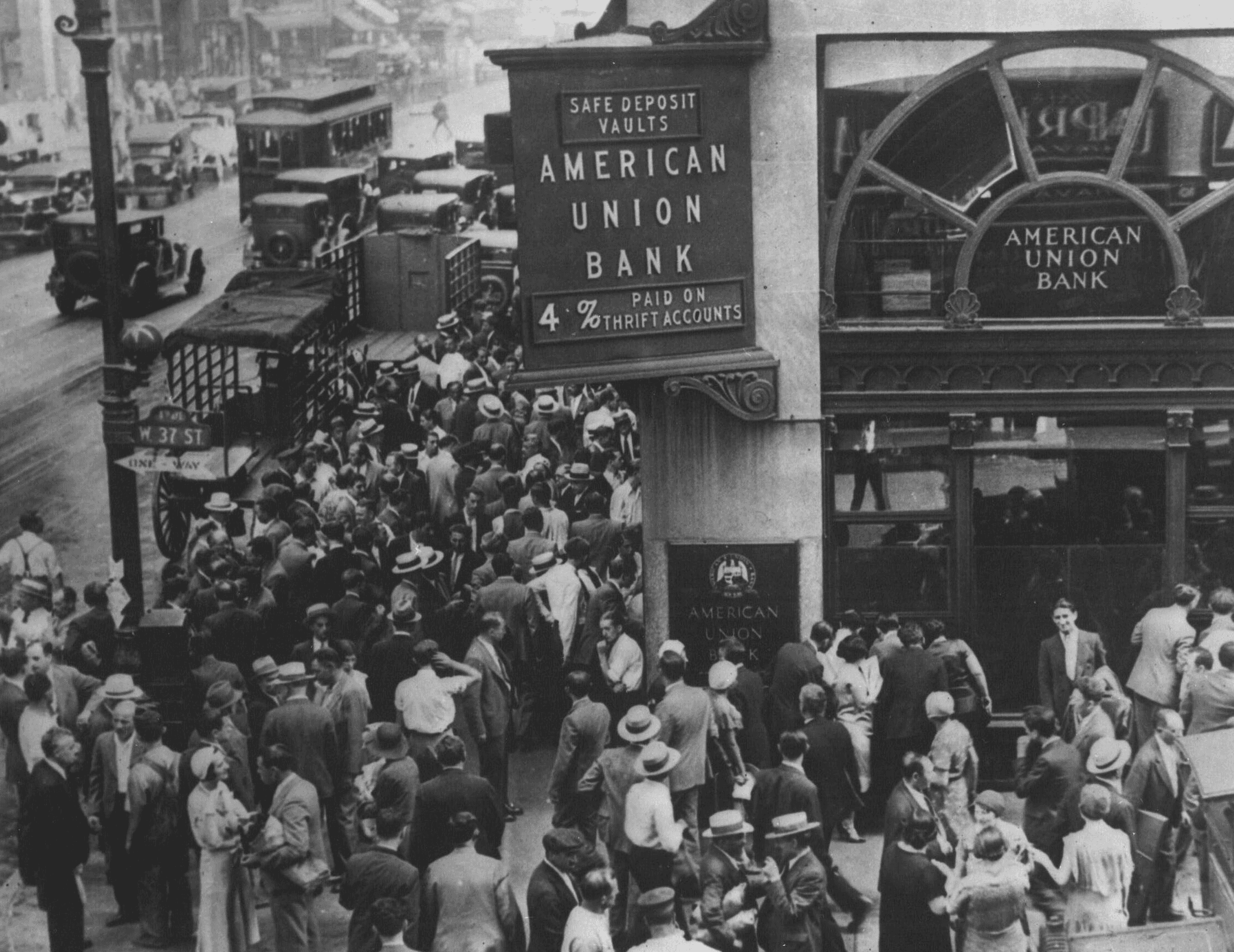

The Great Depression, which began with the stock market crash of 1929, was a decade-long economic catastrophe. Unemployment soared to unprecedented levels (at one point almost 1 out of every 4 Americans was unemployed), industrial production plummeted, and families struggled to make ends meet. The banking system teetered on the brink of collapse, and public confidence in the economy was completely shattered. With this level of uncertainty, I could understand why our grandparents kept cash in their mattress instead of leaving it with the bank. 9,000 banks failed taking $7 billion in depositors’ assets with them (there was no FDIC insurance) – that’s $7 billion from the 1930s,which is worth much more in today’s terms. (fdrlibrary.org, ssa.gov)

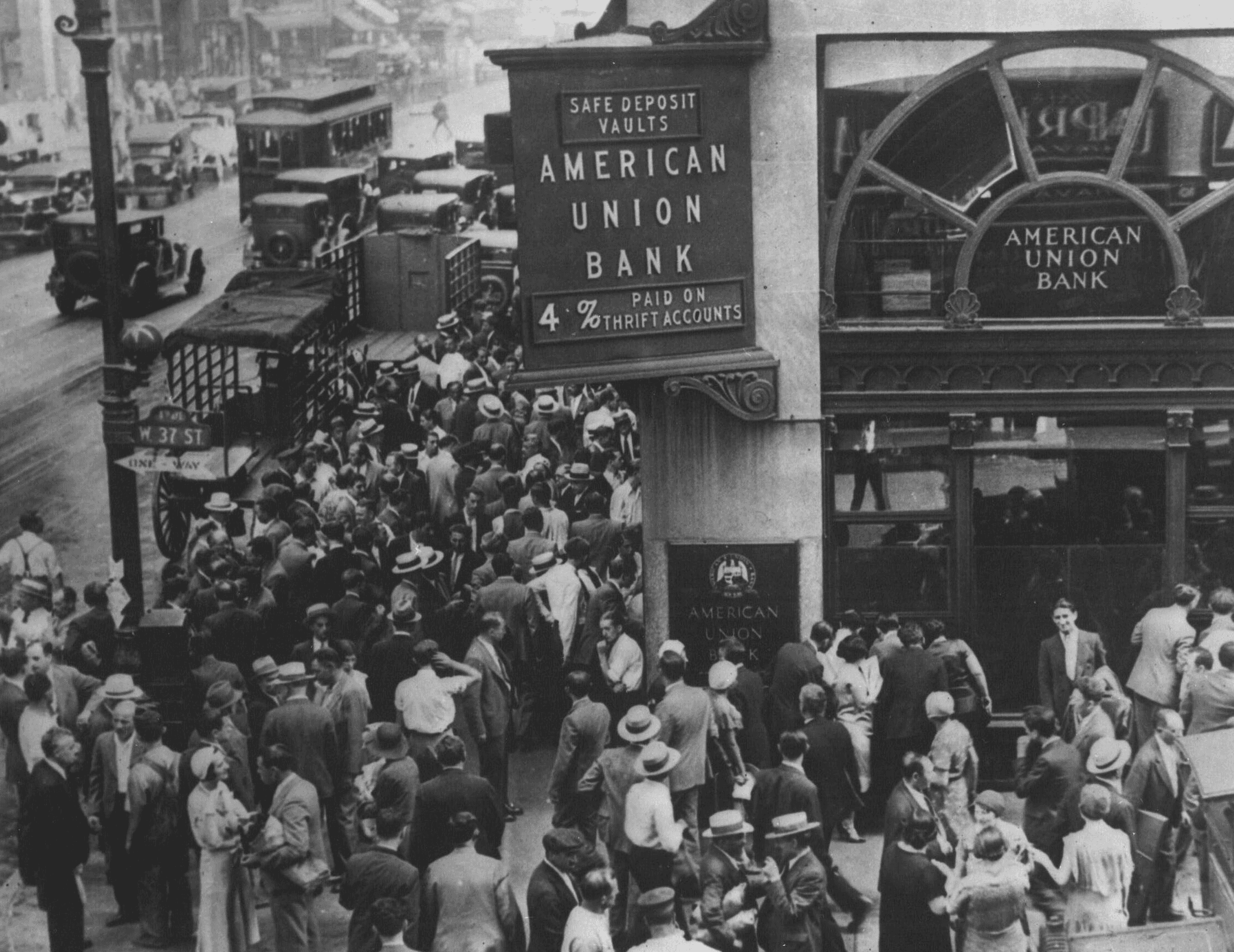

People waiting in line to withdraw their physical cash (No apps to transfer $ yet!!)

Background: 2023 Market Conditions

Fast forward to 2023, and the landscape is extremely different. The United States, like much of the world, experienced significant economic challenges due to the covid pandemic, but it has since embarked on a path of recovery. Key economic indicators such as employment rates and GDP growth are generally positive as they have been presented. However, it's important to note that economic conditions can be multifaceted, with some sectors and groups experiencing greater challenges than others. For example, small businesses (which employ 47%of the workforce in the USA and represent 99.9% of all businesses) were hit hard. From January 2020 to May 2021, 34% of all small businesses shut down – with San Francisco losing 48% of small businesses in that same time period. This left a massive opportunity for larger corporations to capture more revenue in their markets... and they did. While this may not be 100% explained by small business failures, in May 2021 the Labor Department reported that 7.9 million people couldn’t work because their employer closed or lost too much business to employ them. Think about who this hurt the most. Quick hint: it wasn’t wall street, big tech, or big pharma. (weforum.org, bls.gov)

The Role of Ole Uncle Sam (aka the Federal Government)

One stark contrast between the two eras lies in the approach to government intervention. During the Great Depression, the federal government initially failed to respond effectively. It was not until the New Deal policies of President Franklin D. Roosevelt that substantial government intervention began, including initiatives aimed at job creation, infrastructure development, and financial sector regulation. The New Deal laid the groundwork for many social programs that exist today (legally protected unions, social security, glass-steagall (super important!), and much more). On a note much less talked about, FDR legitimately made it illegal to 'hoard gold coins, gold bullion, and gold certifications within the continental United States' and remained illegal until the 1970's. Citizens were compensated way below market value for their confiscated gold, and then left holding a piece of paper... Once the government had the gold it raised the official exchange rate for gold <> USD. This is back when our country was on the gold standard, and was effectively the pre-Federal Reserve version of printing money (investopedia.com/gold reserve act of 1934). This has me thinking it could be worth talking about the difference between intrinsic and extrinsic value...

In 2023, the government's response has been markedly different. Various forms of economic stimulus, relief packages, and monetary policy measures were quickly implemented during the covid pandemic to support businesses, individuals, and healthcare efforts. The role of governmental stabilizing the economy and addressing societal needs has been more proactive, but it remains to be seen if it was ultimately effective in the long run.

Technological Advancements and Globalization

Another fundamental difference between the two eras is the profound impact of technological advancements and globalization on the 2023 market conditions. Today, technology plays a central role in commerce and communication, creating new industries and opportunities. Globalization has interconnected economies in ways that were unimaginable during the Great Depression. It’s hard to say the specific impact globalization has had, but in the most blunt way to describe it’s impact – with an interconnected global economy, we now share almost everything with almost every country. Whether that is a benefit for everyone, or a contagion that spreads throughout the world (economic or physical).

The US Stock Market: Then and Now

The stock market crash of 1929 remains synonymous with the Great Depression because it kicked off the decade of misery. In contrast, the 2023 stock market has displayed resilience. While it has experienced fluctuations and corrections, it has rebounded from the pandemic-induced crash. This difference underscores the importance of a diverse and adaptable economy in the face of challenges, but also possibly shows just how influential the US federal government and the Fed reserve are with their policies. US stocks were in freefall until the Fed decided to lower the fed funds rate (which is explained in more depth in this post), debt payments were put on hold, and then consumer spending was boosted by ‘covid checks’ being sent out. I certainly am keeping an eye on the long-term ramifications, some of which we have felt with extremely high inflation.

Safety Nets and Welfare Programs

Social safety nets and welfare programs are more robust in 2023 compared to the Great Depression era. Programs like Social Security, Medicare, Medicaid, and unemployment benefits provide a safety net that was not nearly as comprehensive during the 1930s. These programs have played a vital role in mitigating the social and economic impacts of recent crises and was a significant precedent established by FDR's and New Deal.

Conclusion

While there may be echoes of the past in our current market conditions, the Great Depression and 2023 have unique contexts, challenges, and responses. We can draw lessons from the past to inform our decisions today to best prepare for what tomorrow holds, but at the end of the day it’s near impossible to stay on top of all these moving parts while also holding a job and taking care of your family. That’s why we need banks like Hive, because we will make it extremely easy for you to keep tabs on the safety of your money, vote for financial products that are most relevant to your needs in a constantly shifting financial landscape, and access the highest quality financial products on the market. With your help, we will force banking to evolve and become stronger in the face of uncertain times.

How Did This Come Up? (Fair question)

I went down a deep rabbit hole this week. I saw something on Instagram comparing the great depression to today, and some of the data made me think about where our economy is REALLY at. While we won't get into the weeds in this post (happy to do it if you all ask me to!), history has a curious way of echoing through time with patterns and lessons from the past occasionally resurfacing in the present. So I thought it would be worst visiting the topic. In economic history, the Great Depression of the 1930s stands as one of the most harrowing chapters, marked by widespread unemployment, financial turmoil, and social upheaval. As we navigate the difficult conditions of today, it's worth thinking about the parallels and differences between these two times.

Background: The Great Depression

The Great Depression, which began with the stock market crash of 1929, was a decade-long economic catastrophe. Unemployment soared to unprecedented levels (at one point almost 1 out of every 4 Americans was unemployed), industrial production plummeted, and families struggled to make ends meet. The banking system teetered on the brink of collapse, and public confidence in the economy was completely shattered. With this level of uncertainty, I could understand why our grandparents kept cash in their mattress instead of leaving it with the bank. 9,000 banks failed taking $7 billion in depositors’ assets with them (there was no FDIC insurance) – that’s $7 billion from the 1930s,which is worth much more in today’s terms. (fdrlibrary.org, ssa.gov)

People waiting in line to withdraw their physical cash (No apps to transfer $ yet!!)

Background: 2023 Market Conditions

Fast forward to 2023, and the landscape is extremely different. The United States, like much of the world, experienced significant economic challenges due to the covid pandemic, but it has since embarked on a path of recovery. Key economic indicators such as employment rates and GDP growth are generally positive as they have been presented. However, it's important to note that economic conditions can be multifaceted, with some sectors and groups experiencing greater challenges than others. For example, small businesses (which employ 47%of the workforce in the USA and represent 99.9% of all businesses) were hit hard. From January 2020 to May 2021, 34% of all small businesses shut down – with San Francisco losing 48% of small businesses in that same time period. This left a massive opportunity for larger corporations to capture more revenue in their markets... and they did. While this may not be 100% explained by small business failures, in May 2021 the Labor Department reported that 7.9 million people couldn’t work because their employer closed or lost too much business to employ them. Think about who this hurt the most. Quick hint: it wasn’t wall street, big tech, or big pharma. (weforum.org, bls.gov)

The Role of Ole Uncle Sam (aka the Federal Government)

One stark contrast between the two eras lies in the approach to government intervention. During the Great Depression, the federal government initially failed to respond effectively. It was not until the New Deal policies of President Franklin D. Roosevelt that substantial government intervention began, including initiatives aimed at job creation, infrastructure development, and financial sector regulation. The New Deal laid the groundwork for many social programs that exist today (legally protected unions, social security, glass-steagall (super important!), and much more). On a note much less talked about, FDR legitimately made it illegal to 'hoard gold coins, gold bullion, and gold certifications within the continental United States' and remained illegal until the 1970's. Citizens were compensated way below market value for their confiscated gold, and then left holding a piece of paper... Once the government had the gold it raised the official exchange rate for gold <> USD. This is back when our country was on the gold standard, and was effectively the pre-Federal Reserve version of printing money (investopedia.com/gold reserve act of 1934). This has me thinking it could be worth talking about the difference between intrinsic and extrinsic value...

In 2023, the government's response has been markedly different. Various forms of economic stimulus, relief packages, and monetary policy measures were quickly implemented during the covid pandemic to support businesses, individuals, and healthcare efforts. The role of governmental stabilizing the economy and addressing societal needs has been more proactive, but it remains to be seen if it was ultimately effective in the long run.

Technological Advancements and Globalization

Another fundamental difference between the two eras is the profound impact of technological advancements and globalization on the 2023 market conditions. Today, technology plays a central role in commerce and communication, creating new industries and opportunities. Globalization has interconnected economies in ways that were unimaginable during the Great Depression. It’s hard to say the specific impact globalization has had, but in the most blunt way to describe it’s impact – with an interconnected global economy, we now share almost everything with almost every country. Whether that is a benefit for everyone, or a contagion that spreads throughout the world (economic or physical).

The US Stock Market: Then and Now

The stock market crash of 1929 remains synonymous with the Great Depression because it kicked off the decade of misery. In contrast, the 2023 stock market has displayed resilience. While it has experienced fluctuations and corrections, it has rebounded from the pandemic-induced crash. This difference underscores the importance of a diverse and adaptable economy in the face of challenges, but also possibly shows just how influential the US federal government and the Fed reserve are with their policies. US stocks were in freefall until the Fed decided to lower the fed funds rate (which is explained in more depth in this post), debt payments were put on hold, and then consumer spending was boosted by ‘covid checks’ being sent out. I certainly am keeping an eye on the long-term ramifications, some of which we have felt with extremely high inflation.

Safety Nets and Welfare Programs

Social safety nets and welfare programs are more robust in 2023 compared to the Great Depression era. Programs like Social Security, Medicare, Medicaid, and unemployment benefits provide a safety net that was not nearly as comprehensive during the 1930s. These programs have played a vital role in mitigating the social and economic impacts of recent crises and was a significant precedent established by FDR's and New Deal.

Conclusion

While there may be echoes of the past in our current market conditions, the Great Depression and 2023 have unique contexts, challenges, and responses. We can draw lessons from the past to inform our decisions today to best prepare for what tomorrow holds, but at the end of the day it’s near impossible to stay on top of all these moving parts while also holding a job and taking care of your family. That’s why we need banks like Hive, because we will make it extremely easy for you to keep tabs on the safety of your money, vote for financial products that are most relevant to your needs in a constantly shifting financial landscape, and access the highest quality financial products on the market. With your help, we will force banking to evolve and become stronger in the face of uncertain times.

How Did This Come Up? (Fair question)

I went down a deep rabbit hole this week. I saw something on Instagram comparing the great depression to today, and some of the data made me think about where our economy is REALLY at. While we won't get into the weeds in this post (happy to do it if you all ask me to!), history has a curious way of echoing through time with patterns and lessons from the past occasionally resurfacing in the present. So I thought it would be worst visiting the topic. In economic history, the Great Depression of the 1930s stands as one of the most harrowing chapters, marked by widespread unemployment, financial turmoil, and social upheaval. As we navigate the difficult conditions of today, it's worth thinking about the parallels and differences between these two times.

Background: The Great Depression

The Great Depression, which began with the stock market crash of 1929, was a decade-long economic catastrophe. Unemployment soared to unprecedented levels (at one point almost 1 out of every 4 Americans was unemployed), industrial production plummeted, and families struggled to make ends meet. The banking system teetered on the brink of collapse, and public confidence in the economy was completely shattered. With this level of uncertainty, I could understand why our grandparents kept cash in their mattress instead of leaving it with the bank. 9,000 banks failed taking $7 billion in depositors’ assets with them (there was no FDIC insurance) – that’s $7 billion from the 1930s,which is worth much more in today’s terms. (fdrlibrary.org, ssa.gov)

People waiting in line to withdraw their physical cash (No apps to transfer $ yet!!)

Background: 2023 Market Conditions

Fast forward to 2023, and the landscape is extremely different. The United States, like much of the world, experienced significant economic challenges due to the covid pandemic, but it has since embarked on a path of recovery. Key economic indicators such as employment rates and GDP growth are generally positive as they have been presented. However, it's important to note that economic conditions can be multifaceted, with some sectors and groups experiencing greater challenges than others. For example, small businesses (which employ 47%of the workforce in the USA and represent 99.9% of all businesses) were hit hard. From January 2020 to May 2021, 34% of all small businesses shut down – with San Francisco losing 48% of small businesses in that same time period. This left a massive opportunity for larger corporations to capture more revenue in their markets... and they did. While this may not be 100% explained by small business failures, in May 2021 the Labor Department reported that 7.9 million people couldn’t work because their employer closed or lost too much business to employ them. Think about who this hurt the most. Quick hint: it wasn’t wall street, big tech, or big pharma. (weforum.org, bls.gov)

The Role of Ole Uncle Sam (aka the Federal Government)

One stark contrast between the two eras lies in the approach to government intervention. During the Great Depression, the federal government initially failed to respond effectively. It was not until the New Deal policies of President Franklin D. Roosevelt that substantial government intervention began, including initiatives aimed at job creation, infrastructure development, and financial sector regulation. The New Deal laid the groundwork for many social programs that exist today (legally protected unions, social security, glass-steagall (super important!), and much more). On a note much less talked about, FDR legitimately made it illegal to 'hoard gold coins, gold bullion, and gold certifications within the continental United States' and remained illegal until the 1970's. Citizens were compensated way below market value for their confiscated gold, and then left holding a piece of paper... Once the government had the gold it raised the official exchange rate for gold <> USD. This is back when our country was on the gold standard, and was effectively the pre-Federal Reserve version of printing money (investopedia.com/gold reserve act of 1934). This has me thinking it could be worth talking about the difference between intrinsic and extrinsic value...

In 2023, the government's response has been markedly different. Various forms of economic stimulus, relief packages, and monetary policy measures were quickly implemented during the covid pandemic to support businesses, individuals, and healthcare efforts. The role of governmental stabilizing the economy and addressing societal needs has been more proactive, but it remains to be seen if it was ultimately effective in the long run.

Technological Advancements and Globalization

Another fundamental difference between the two eras is the profound impact of technological advancements and globalization on the 2023 market conditions. Today, technology plays a central role in commerce and communication, creating new industries and opportunities. Globalization has interconnected economies in ways that were unimaginable during the Great Depression. It’s hard to say the specific impact globalization has had, but in the most blunt way to describe it’s impact – with an interconnected global economy, we now share almost everything with almost every country. Whether that is a benefit for everyone, or a contagion that spreads throughout the world (economic or physical).

The US Stock Market: Then and Now

The stock market crash of 1929 remains synonymous with the Great Depression because it kicked off the decade of misery. In contrast, the 2023 stock market has displayed resilience. While it has experienced fluctuations and corrections, it has rebounded from the pandemic-induced crash. This difference underscores the importance of a diverse and adaptable economy in the face of challenges, but also possibly shows just how influential the US federal government and the Fed reserve are with their policies. US stocks were in freefall until the Fed decided to lower the fed funds rate (which is explained in more depth in this post), debt payments were put on hold, and then consumer spending was boosted by ‘covid checks’ being sent out. I certainly am keeping an eye on the long-term ramifications, some of which we have felt with extremely high inflation.

Safety Nets and Welfare Programs

Social safety nets and welfare programs are more robust in 2023 compared to the Great Depression era. Programs like Social Security, Medicare, Medicaid, and unemployment benefits provide a safety net that was not nearly as comprehensive during the 1930s. These programs have played a vital role in mitigating the social and economic impacts of recent crises and was a significant precedent established by FDR's and New Deal.

Conclusion

While there may be echoes of the past in our current market conditions, the Great Depression and 2023 have unique contexts, challenges, and responses. We can draw lessons from the past to inform our decisions today to best prepare for what tomorrow holds, but at the end of the day it’s near impossible to stay on top of all these moving parts while also holding a job and taking care of your family. That’s why we need banks like Hive, because we will make it extremely easy for you to keep tabs on the safety of your money, vote for financial products that are most relevant to your needs in a constantly shifting financial landscape, and access the highest quality financial products on the market. With your help, we will force banking to evolve and become stronger in the face of uncertain times.